Notre institut est spécialisé dans la thérapie capillaire, les perruques médicales et les compléments hommes et femmes.

Nous travaillons avec notre marque de prothèses, qui propose des modèles conçus avec les concepts Antiglisse© et Modulocap© permettant d’offrir une tenue optimale sans risque de compression, de transpiration et ce, en toute discrétion !

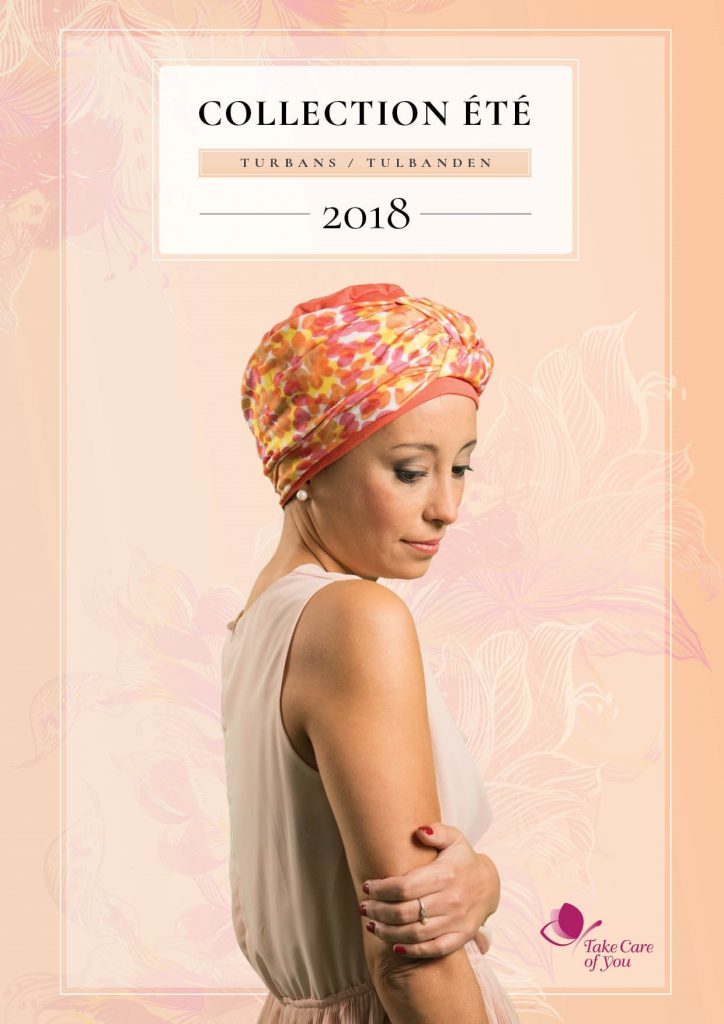

Les turbans et foulards sont spécialement conçus en coton produit sous le label OEKO-TEX®, un coton sans trace de produit chimique et conforme à la législation et la réglementation en vigueur concernant l’usage de substances nuisibles pour protéger votre cuir chevelu affaibli suite à une perte de cheveux ou un traitement en chimiothérapie, et/ou en bambou, un tissu moderne aux nombreuses qualités et surtout d’une douceur exceptionnelle.

L’espace Clinique du Cheveu propose un diagnostic capillaire complet grâce à son microscope, sa caméra et son logiciel spécifique, nous pouvons établir un diagnostic personnalisé et complet à la fois sur l’état de vos cheveux, de vos bulbes mais également sur tous les paramètres importants sur la vitalité et la bonne santé de vos cheveux. mais aussi votre cuir chevelu afin d’établir un bilan personnalisé.

Chute de cheveux, cheveux secs, gras, ou des pellicules…

Quel que soit votre problème, nous mettons en place ensemble des traitements adaptés et personnalisés. Nous utilisons des soins d’origine biologique et naturelle adaptés à tous les cuirs chevelus et problèmes de cheveux.